capital gains tax increase uk

In line with the increase in the main rate the UK Diverted Profits Tax rate will also rise to 31 from April 2023. Record amounts of capital gains and tax were recorded in the 2020 to 2021 tax year.

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

The following Capital Gains Tax rates apply.

. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Individuals have a personal allowance of 12300 a year meaning that no capital gains tax is payable on. Its the gain you make thats taxed not the amount of money you.

Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and. Or could the tax rate be retroactively applied to the 202122 tax year. This would bring the capital.

This measure reduces the 18 rate of CGT to 10 and the 28 rate of CGT to 20 for chargeable gains except in relation to chargeable gains accruing on the disposal of. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as the top slice of income. You only have to pay capital gains tax on certain assets and do not have to pay it at all if your gains are under your tax free allowance which is 12300 or 6150 for trusts.

If you pay the basic rate of capital gains tax your bill depends on the size of your gain your taxable income and whether your gain is from residential property or other. Any amount above the basic tax rate will hit the 20 charge on assets and 28 for residential property. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Tax when you sell your home. Tell HMRC about Capital Gains Tax on.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. The capital gains tax-free allowance for the 2021-22 tax year is 12300. Fewer and higher rates of CGT.

Tax when you sell property. We currently have 4 different rates of CGT 10 18 20. Under the current system income which covers earnings such as salaries is taxed at a maximum rate of 45.

One of the areas the government is looking to increase its tax collection from is capital gains. Currently there are four rates of CGT being 18 and 28 on UK. The rates for higher rate taxpayers are 20 and 28 respectively.

Tax if you live abroad and sell your UK home. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if. The report includes recommendations for simplification under 4 key headings.

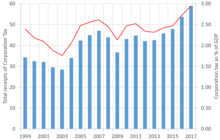

The total amount of tax liability was 143 billion and this was an increase of 42 from the 2019 to. Capital Gains Tax rates in the UK for 202223. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property.

Add this to your taxable income. Because the combined amount of 20300 is less than 37700 the. Simply put capital gains tax CGT is paid when an asset other than your main residence is sold at a profit.

18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work. The OTS made a recommendation to scale back the capital gains tax. Note that short-term capital gains taxes are even higher.

Work out tax relief when you sell your home. Capital gains the profit made when an asset such as.

How To Avoid Paying Tax On Capital Gains Youtube

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

The Politics And Economics Of The Capital Gain Tax Cato At Liberty Blog

2021 Capital Gains Tax Rates In Europe Tax Foundation

Rishi Sunak Orders Review Of Capital Gains Tax Amid Fears Of Rate Increase

How Much Is Capital Gains Tax Cgt Rates Explained And Budget Proposal Nationalworld

5 Potential Tax Changes That Could Help Pay The Coronavirus Debt

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Capital Gains Tax Rates And Economic Growth Or Not

Capital Gains Tax When Selling A Business Asset 1st Formations

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How To Plan For Tomorrowa S Higher Taxes Financial Times Partner Content By Barclays Wealth Management

Proposals To Increase Capital Gains Tax In Uk Could Make Guernsey An Even More Attractive Relocation Proposition Swoffers

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax Rishi Sunak Urged To Mount 14bn Raid On Second Home Owners And Stock Investors

Increase Of Capital Gains Tax To Help Pay For Covid 19 Birkett Long Solicitors